icapital.biz Berhad

Discover icapital.biz Berhad (ICAP, 5108), the only closed-end fund listed on Bursa Malaysia and your gateway

to professional fund management designed specifically for individual investors. ICAP ensures individual investors

receive the same level of strategic investment management typically reserved for institutional clients at an affordable price.

The primary investment objective of ICAP is long-term capital appreciation of its investments whilst dividend and/or interest

income from these investments would be of secondary consideration. ICAP invests in undervalued companies which are listed on

the Main Market of Bursa Malaysia Securities Berhad (Bursa Securities) and the ACE Market of Bursa Securities.

It can also invest in cash deposits and up to 10% of its asset value in unlisted companies.

ICAP's asset allocation is a function of its value investing philosophy and can range from 0% equities to 100% equities.

With RM140 million paid-up capital, ICAP has a fixed number of outstanding shares at any point in time. Like other

publicly traded companies, ICAP’s share price is determined entirely by market supply and demand. Similarly, ICAP shares

are bought and sold in the stock market via licensed stockbroking companies.

Before its listing on 19 October 2005, the aim has been to increase the value of ICAP. This is achieved by adhering to a

value investing philosophy. As a value investor, investments will be selected based on their market prices and underlying

values. Unless unanimously approved by the share owners, ICAP is not allowed to borrow.

The appropriate tool to evaluate ICAP’s performance is its Net Asset Value and not by looking at its share price performance,

earnings or earnings per share or its profit and loss statement.

A Low Risk, High Return Investment

Even during turbulent times, ICAP has been outperforming Bursa Malaysia. Since its inception in 2005 with net asset size of RM140 million,

its net asset value (NAV) has grown to over RM569 million as at 7 August 2024.

ICAP allows the power of compounding to work for shareowners. Remarkably, if you had invested RM1,000 during its IPO, your investment

would be worth RM4,300 now.

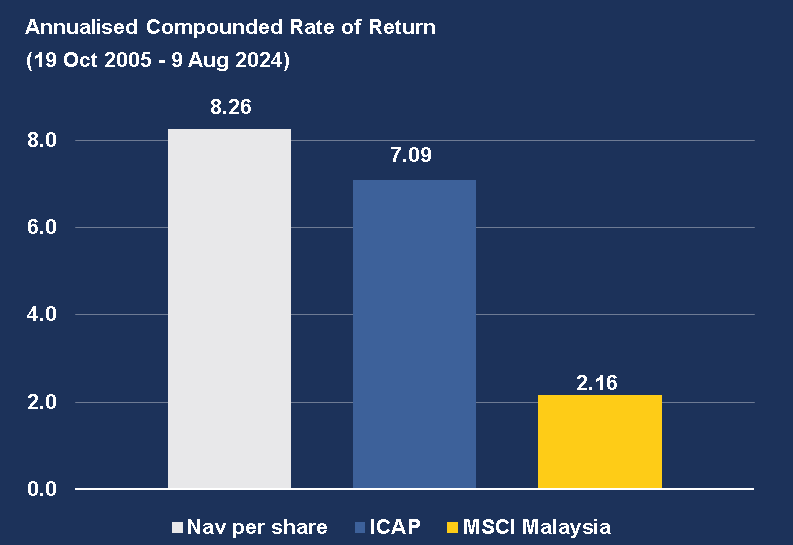

Since inception in 2005 to 9 August 2024, the annualised compound rate of return of ICAP’s NAV per share and market price

are 8.26% and 7.09% respectively, nearly 4 times MSCI Malaysia’s annualised compound rate of return which is 2.16%.

*Disclaimer: The performance of icapital.biz Berhad for the period 19 Oct 2005 to 31 Dec 2016 has been independently verified.

The performance for the period 1 Jan 2017 to 9 Aug 2024 is believed to be reliable but has not been independently verified.

Past performance and any forecast are not necessarily indicative of future or likely performance.

Innovative Dividend Policy

ICAP’s innovative dividend policy is the definition of ‘have your cake and eat it too’. It is formulated as follows:

Total = Base rate + Top-up rate

Base rate: 1% of ICAP’s NAV per share

Top-up rate: 8% of the difference between ICAP’s share price and NAV

When the discount is wider, the top-up rate increases.

Shareowners will receive a higher dividend. When the

discount narrows, the lower dividend will be compensated

by capital appreciation.

ICAP currently has over 3,200 shareholders. With a fixed capital structure and shares traded publicly,

it offers an opportunity for investors to be part of a managed portfolio. For only around RM300,

you can invest in ICAP and benefit from long-term growth.

Capital Dynamics Asset Management Sdn Bhd (CDAM) manages the fund, while Capital Dynamics Sdn Bhd (CDSB)

provides investment advice and oversight.

For more information, visit www.icapital.my.